Altcoins are pretty much any crypto that’s not Bitcoin, and honestly, getting into Bitcoin alternatives back in 2021 felt like a total rush while I was holed up in my tiny apartment in Texas, chugging energy drinks and staring at screens till dawn. Right now, on this muggy January 3, 2026 morning in Florida—the AC’s humming loud, I’ve got a cold coffee going stale next to me, and the humidity is already killing my vibe—altcoins still give me that mix of hype and regret. Like, these Bitcoin alternatives do stuff BTC can’t, faster transactions or smart contracts, but man, the volatility is no joke.

Why Altcoins Hook You Harder Than Bitcoin (My Take Anyway)

Bitcoin’s the king, hovering around $90k today (peep the latest on CoinDesk), seen as digital gold. But altcoins? They’re the wild ones trying to solve Bitcoin’s flaws, like those crazy high fees when the network’s jammed. My first real altcoin play was Ethereum—I dumped in a few hundred bucks thinking I was smart, watched it pump, then sold way too early on a dip. Rookie mistake that still bugs me when I think about it. Anyway, altcoins cover everything from Ethereum’s DeFi world to Solana’s speed demon vibes.

In 2026, with the total market cap sitting around $3.1 trillion, altcoins like Solana, Cardano, and privacy-focused ones like Monero are getting attention for upgrades and real-world use.

My Dumbest Altcoins Screw-Ups (Learn From My Pain, Seriously)

God, the 2022 crash—I FOMO’d hard into some hyped “Ethereum killer” altcoin off Twitter threads, lost big chunks overnight. Woke up sweating, charts bleeding red, my cat judging me hard. Altcoins amplify Bitcoin’s moves, so when BTC dips, Bitcoin alternatives can tank even worse.

- Never chase hype without digging into the project—check the devs, the roadmap.

- Use a cold wallet; I got paranoid after a close call with an exchange glitch.

- Spread it out—my bag now has BTC as the base, then Ethereum, Solana, maybe some Monero for privacy kicks.

Wish I’d started smaller instead of going balls-to-the-wall with money I kinda needed.

Top Altcoins I’m Eyeing as Bitcoin Alternatives This Year

Early 2026, BTC’s pushing $90k-ish, market cap over $3 trillion. Standouts for me: Ethereum for all the DeFi and NFT stuff (even after the Merge), Solana for cheap fast txns—great for apps and memes. Cardano’s slow but solid with research, and privacy coins like Monero if you’re worried about tracking. Bittensor’s popping for AI-crypto mashups too. Head to CoinMarketCap or CoinGecko for real-time ranks.

Some Bitcoin alternatives worth a look:

- Ethereum: Smart contract GOAT.

- Solana: Speed and low fees king.

- Cardano: Steady, academic vibe.

- Monero: Privacy focused, no snooping.

For more, check Forbes’ crypto trends piece or BeInCrypto’s altcoin watches—helps build credibility when you’re second-guessing everything.

How I Actually Research Altcoins Now (Flawed Method, But It Works For Me)

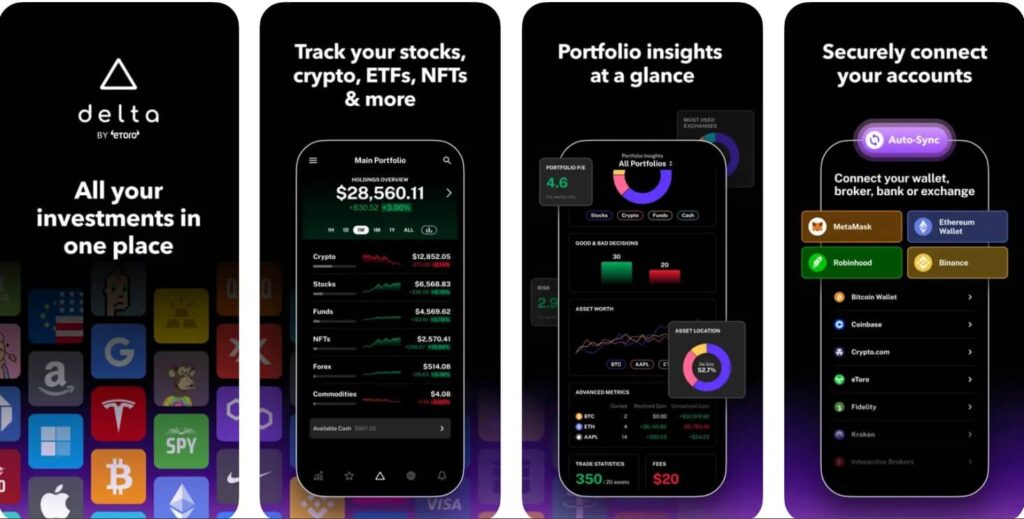

I refresh CoinGecko way too much, skim whitepapers (admit it, I skip parts), and doomscroll Reddit and X. Learned the hard way not to buy pure hype—now I hunt for adoption, upgrades, real utility. In 2026, tokenization, AI stuff, and multi-chain plays feel big.

Outbound links cuz why not: CoinDesk market updates, Investopedia on cryptos beyond Bitcoin.

Contradictions? Yeah, I’m optimistic long-term but terrified of another crash. Crypto’s a rollercoaster, y’all.