Crypto prices are this total mindfuck sometimes, like I’m sitting here in my tiny Brooklyn apartment on January 5, 2026, it’s freezing outside, my window’s got that frosty crap on it, and I’m glued to my screens watching Bitcoin flirt with $93,000 again—saw it hit that mark today according to some headlines, though CoinDesk had it around 91k yesterday, whatever, it’s bouncing.

I remember getting wrecked in 2021, went all in on Dogecoin ’cause everyone was yelling about it, lost half my savings when it tanked, sat there staring at my phone in the middle of the night feeling like a complete moron. But that mess taught me crypto prices boil down to supply, demand, and a whole lotta hype that can pump or dump everything overnight.

Why Supply Plays a Huge Role in Crypto Prices (Even If It’s Boring)

Supply is the foundation for a lot of crypto prices, especially Bitcoin with its hard cap at 21 million. The 2024 halving back in April cut the new supply in half, and yeah, historically that scarcity kicks in and boosts cryptocurrency value over time—check this Investopedia piece on how halvings work: https://www.investopedia.com/bitcoin-halving-4843769.

Right now in early 2026, Bitcoin’s hovering in the low to mid-90s, feels stable-ish after some wild swings last year. I timed it wrong after the last halving, sold low during a dip, bought high later—classic me, always chasing.

- Bitcoin’s fixed supply creates real scarcity

- Altcoins with no cap can get flooded if hype dies

- Things like coin burns or lost wallets tighten supply unexpectedly

Demand is where it gets exciting though, that’s the human side driving crypto prices.

Demand: What Actually Pushes Crypto Market Hype and Prices Up

Demand for crypto prices comes from folks wanting to buy and use it. Last year saw big institutional money via ETFs, helped push things up before corrections. Ethereum’s chilling around $3,150 today, not exploding but steady with all the staking and DeFi stuff.

My dumb move: chased some AI meme coin hype in 2025, thought it’d moon, ended up down 80%, woke up sweating checking my portfolio. Hype spikes demand fast, but when it crashes, crypto prices follow hard.

Stuff that builds real demand:

- Actual adoption for payments or value storage

- DeFi exploding with lending and yields

- Big players like companies or even governments stacking

But hype? Man, that’s the chaos amplifier for crypto volatility.

Hype: The Part That Screws With Crypto Prices Most (My Embarrassing Stories)

Hype is straight-up emotional jet fuel for crypto prices—or a nuke. 2025 had Trump stuff, ETF flows pumping early, then pullbacks when things cooled. Bitcoin peaked over 100k I think, now back in 90s.

I bought Solana on a dip, rode it up, panicked during a crash and sold—missed the recovery, still mad at myself. Hype triggers FOMO buys, then fear sells, making supply/demand swings insane.

Things that hyped me into bad trades:

- Celeb tweets pumping random coins

- “Moon soon” narratives on every new trend

- Media calling tops and bottoms, always wrong

This CoinDesk article touches on recent hype vs real factors: https://www.coindesk.com/markets/2026/01/04/bitcoin-tops-usd91-000-with-ether-dogecoin-higher-amid-u-s-action-on-venezuela

Wrapping My Ramble on Crypto Prices: Supply, Demand, Hype Chaos

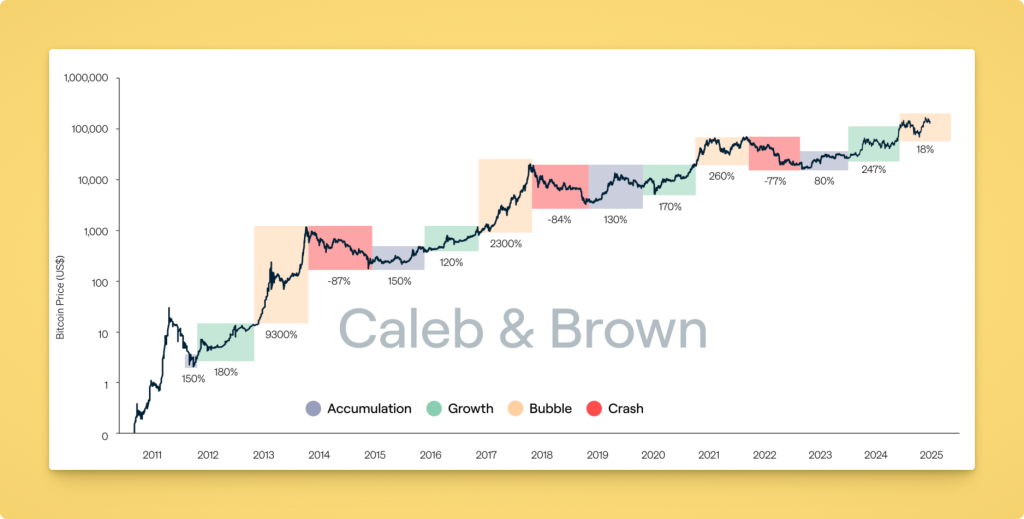

Honestly, crypto prices will always be volatile ’cause supply’s rigid, demand’s fickle humans, and hype’s uncontrollable. I’ve burned myself enough to know: don’t go all in with money you need, spread it out, and try to zoom out long-term—Bitcoin’s crushed it over years despite the dumps.

Tips from my mistakes:

- Watch actual on-chain data, not just social noise

- DCA instead of trying to time perfectly (I suck at timing)

- Brace for swings or just don’t play—it’s rough on the nerves

I flip-flop too, say I’m long-term then sell on red days. That’s me, flawed as hell.

Anyway, that’s my take on crypto prices explained: scarcity + utility + wild hype = this crazy ride. If you’re getting in, go slow, learn from idiots like me.