What is crypto trading exactly? I’m here in my kinda messy Brooklyn apartment on this January 5th, 2026 morning—it’s actually pretty cold out, heater’s humming but my feet are still freezing—and I’m sipping coffee that’s gone lukewarm again because I got distracted scrolling charts. Crypto trading is pretty much buying and selling digital currencies like Bitcoin, Ethereum, or those random altcoins, trying to profit from the price going up or down. It’s all decentralized on the blockchain, no banks bossing you around, just pure market madness driven by news, tweets, and big players moving money. I got into it back in late ’24 thinking it’d be easy money, but lol, it’s been more like an emotional rollercoaster with extra fees.

My First Chaotic Jump Into What Crypto Trading Really Hits Like

True story, my first real trade was a disaster. Some dude on X was pumping this dog-themed coin, I FOMO’d in with $400 I kinda needed for rent—woke up to it tanked 60%, I was pacing my kitchen at like 4am, radiator banging, heart racing, smelling last night’s takeout still. That’s what crypto trading does to you: highs feel amazing, lows make you question life choices. Anyway, learned quick that hype isn’t research.

How to Start Crypto Trading Without Totally Messing Up (Like I Did At First)

Wondering how to start crypto trading? Pick a decent exchange. I began with Coinbase ’cause it’s easy for Americans and has some protection—check it: https://www.coinbase.com/. Then moved to Kraken for cheaper fees and more options: https://www.kraken.com/. Binance.US works too but regs are weird sometimes.

Loose steps from my trial-and-error:

- Sign up, do the KYC thing (annoying selfies and ID).

- Link bank, deposit USD—avoid cards, fees kill ya.

- Start super small, like $50-100.

- Get a proper wallet quick. I finally got a Ledger: https://www.ledger.com/. Way safer than leaving coins on exchanges.

Crypto Trading Basics: Dealing With Charts, Volatility, and Not Losing Your Mind

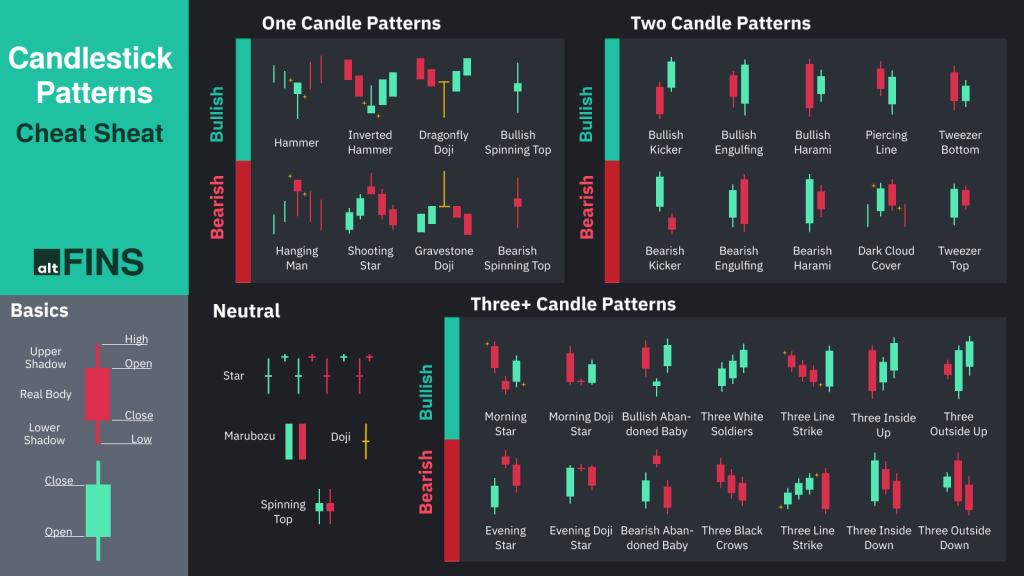

Crypto trading revolves around those candlestick charts that look intense. Volatility is no joke—prices swing wild, Bitcoin can drop 10-20% easy in a day. I wasted so many nights staring at TradingView, snow outside my window last year, trying to figure patterns.

Tips from my many faceplants:

- Watch support/resistance levels.

- Always use stop-losses (I skipped once, regretted big).

- Don’t chase every pump.

- Try DCA—buy fixed amounts regularly, smooths the craziness.

These kinda charts still give me anxiety flashbacks, all red candles everywhere.

My Worst Crypto Trading Mistakes (And the Occasional Wins)

Been rekt plenty—sold lows in panic, bought highs on greed. Feels exactly like this sometimes:

But wins? Rare but sweet, like fist-pumping alone in my room:

Check actual projects on CoinMarketCap: https://coinmarketcap.com/ or CoinGecko: https://www.coingecko.com/. Better than shady groups.

Alright, Rambling Over on What Crypto Trading Is to Me

So yeah, what is crypto trading now? Still stressful addiction mixed with hope, teaches you about greed and patience the hard way. I’m just a regular flawed guy in the US, screwing up sometimes, winning rarely, but can’t quit watching charts while the city wakes up. It’s contradictory—I complain but keep going back.

If you’re starting, go tiny, learn nonstop, only risk what you can lose for real. Try paper trading, use those links. And if you survive your first crash, tell me about it sometime. Markets never sleep, guess we don’t either. Stay safe out there, frens. 🚀🫠 Or whatever emoji fits today.