A How Crypto Exchanges Work is pretty much this digital marketplace where people buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, or whatever altcoin is pumping that week, and man, when I first got into it a few years back, I was totally clueless. Like, I’m here in my apartment in Austin on this kinda gray January morning in 2026, heater humming because it’s dipping below 50 outside – Texas weather, right? – and my desk is a disaster with two monitors flickering charts, cold coffee from earlier, and yeah, a crypto exchange is basically my second home now. But starting out? Total nightmare, seriously. I remember sweating over my first trade, fingers hovering, thinking I’d lose everything.

This is basically my setup most days, minus the fancy lighting – spilled a bit of coffee last week, still smells faintly.

How Crypto Exchanges Work in My Daily Chaos

Alright, let’s break it down like I’m explaining to my brother over beers. A crypto exchange matches buyers and sellers, takes a cut in fees, and for beginners, it’s the easiest way to get into crypto without mining or whatever. I started with centralized ones because they’re straightforward – you deposit fiat money, trade, done. But I learned quick that not your keys, not your coins after some close calls.

Kinda looks like this, but my screen’s got more tabs open – Reddit, Twitter, price alerts pinging.

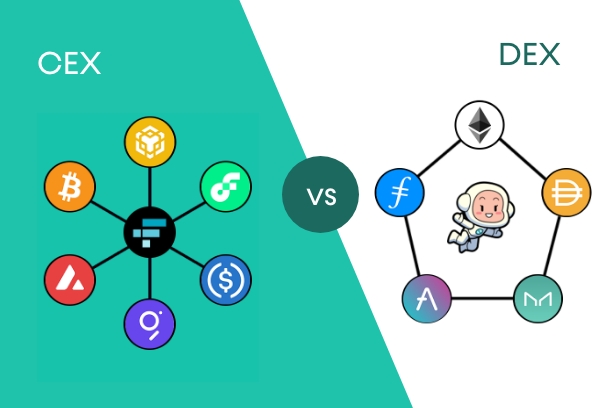

Centralized vs Decentralized Exchanges: My Love-Hate with How Crypto Exchanges Work

Most folks, including past me, kick off with a centralized crypto exchange like Coinbase or Binance.US (since I’m in the states). They’re regulated-ish, have nice apps, and support if you mess up. But fees? Ouch. And custody – they hold your stuff, which bit me during that one market dip when withdrawals slowed.

Then decentralized exchanges like Uniswap blew my mind – no KYC, just connect wallet, swap directly. Super private, but gas fees on Ethereum? I once paid more in fees than the trade, felt so dumb. Liquidity pools, AMMs – it’s cool tech, but slippery for newbies.

Here’s a decent comparison I found that sums it up better than my rambling:

For a deeper dive, CoinDesk has a solid piece: https://www.coindesk.com/learn/cex-vs-dex-whats-the-difference/

And yeah, this captures my face during high gas times:

How to Build a Cryptocurrency Exchange Platform Like Binance?

Step-by-Step: How I Actually Use a Crypto Exchange Now (Beginner Tips from My Mistakes)

If you’re just starting, here’s my no-BS way to buy on a crypto exchange without too much panic:

- Choose one: Coinbase for easy, Kraken for cheaper fees.

- Sign up, do the KYC (takes forever sometimes, I waited a week once).

- Link bank, deposit – ACH is free but slow.

- Search the pair, like ETH/USDT, set limit or market order.

- Buy, then withdraw to your own wallet. Seriously, do this.

This infographic nails the basics:

Binance Academy has great free guides too: https://academy.binance.com/en/articles/a-complete-guide-to-cryptocurrency-trading-for-beginners

Security on Crypto Exchanges: Lessons from My Almost-Disasters

Biggest regret? Leaving too much on exchanges early on. Got a phishing text once, heart stopped – didn’t click, but close. Now: 2FA everywhere, Yubikey if possible, and hardware wallet for anything big.

Investopedia explains wallets well: https://www.investopedia.com/best-crypto-wallets-5215235

Anyway, Wrapping Up My Ramble on How Crypto Exchanges Work

Crypto exchanges are wild – highs feel amazing, lows suck, and I’m still figuring it out years later. Not financial advice, obvs, just my flawed American dude perspective from Texas. Lost money on bad trades, made some back, learned a ton. If you’re dipping in, start tiny, read a bunch, and maybe avoid trading at 2am like I still do sometimes.