Centralized vs decentralized crypto exchanges is something I’ve been obsessing over lately, especially now in early 2026. I’m hunkered down in my Chicago apartment, snow dumping outside—it’s January 5th, heater clunking away, half-eaten pizza on the desk—and I’m staring at my screens, wondering if I should’ve moved everything to a DEX sooner. Like, I started with centralized ones back in the day, felt all secure, but then yeah, some losses hit hard.

My Early Days Messing Around with Centralized Crypto Exchanges

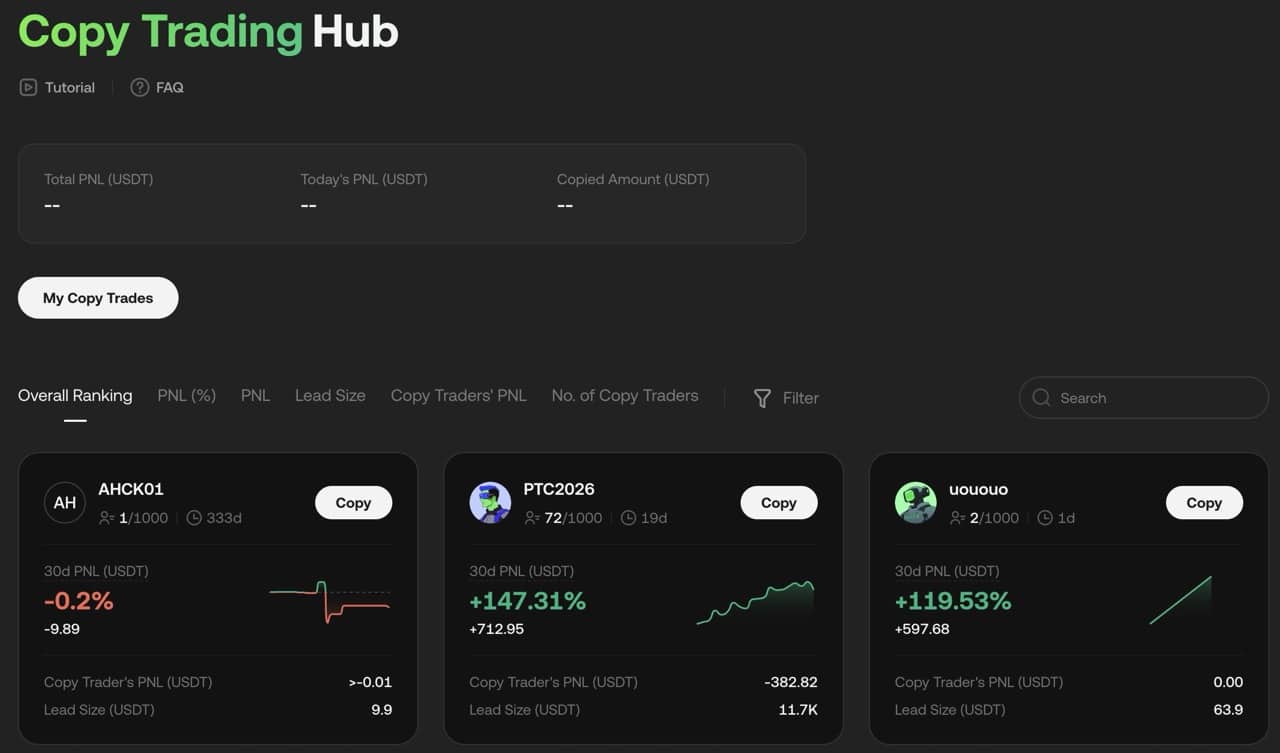

Centralized crypto exchanges, or CEXs, were my gateway drug. Places like Coinbase, Binance, Bybit—they’re run by actual companies, hold your funds, and make everything feel… normal? You deposit USD from your bank, buy crypto easy peasy.

- Super simple apps, even on mobile.

- Crazy high liquidity—trades fill instantly.

- Fiat ramps, perfect for us Americans.

- Sometimes decent support when things go wrong.

But damn, the risks. I had some crypto on FTX back in ’22—nothing huge, but waking up to it vanished? Gut punch. Centralized crypto exchanges are hack magnets or just bad management away from disaster.

In 2026, top centralized ones by volume and trust are Binance, Bybit, Bitget, Coinbase, Kraken—check CoinGecko’s rankings for the latest. They’re still kings for beginners or big trades, but I always withdraw to my own wallet now.

How Decentralized Crypto Exchanges Totally Changed My Game

Then I switched to decentralized crypto exchanges—DEXs—and it was chaotic at first. No middleman, just smart contracts on chains like Ethereum, Solana, or whatever. Connect your wallet, trade direct, you control everything.

My first Uniswap swap? Paid ridiculous gas fees during a peak—felt so stupid, but that control high? Unreal.

What I love about decentralized crypto exchanges now:

- True self-custody—no one can rug you but yourself (and yeah, I’ve almost sent to wrong addresses).

- No KYC, total privacy.

- Early access to new tokens.

- Resistant to shutdowns.

Downsides hit though—slippage on big swaps wrecked me once, and UX isn’t always smooth.

Top DEXs in 2026: Uniswap for Ethereum, Jupiter on Solana, Hyperliquid for perps and speed—again, CoinGecko DEX volume here: https://www.coingecko.com/en/exchanges/decentralized.

Centralized vs Decentralized Crypto Exchanges: Breaking It Down My Way

Honestly, no clear winner in centralized vs decentralized crypto exchanges for me. I hybrid it—use CEX for entry/exit, DEX for DeFi.

| Aspect | Centralized Crypto Exchanges | Decentralized Crypto Exchanges |

|---|---|---|

| Ease of Use | Polished, beginner-friendly | Wallet setup, steeper learning |

| Security | Company custody—hacks possible | Self-custody, but user errors deadly |

| Fees | Often low, but withdrawals add up | Gas volatile, no middleman |

| Liquidity | Massive | Good but slippage on large orders |

| Privacy | KYC mandatory | Anonymous |

Solid comparison over at CoinLedger too: https://coinledger.io/learn/centralized-vs-decentralized-crypto-exchanges.

Lessons from My Centralized and Decentralized Crypto Exchanges Screw-Ups

I’ve bled money both ways—panic sells on CEX dips, gas gouges on DEX rushes. But decentralized crypto exchanges forced me to grow up, get a hardware wallet, double-check everything.

If you’re starting, grab Coinbase for ease (US-friendly: https://www.coinbase.com). Level up to Uniswap or Jupiter later. Just don’t ape in like I did one drunk night—regrets.

Anyway, that’s my messy centralized vs decentralized crypto exchanges rant from this frozen Chicago spot. Both suck and rule in ways. What’s your setup? Comment or ping me. Trade safe, bundle up if it’s winter where you are.